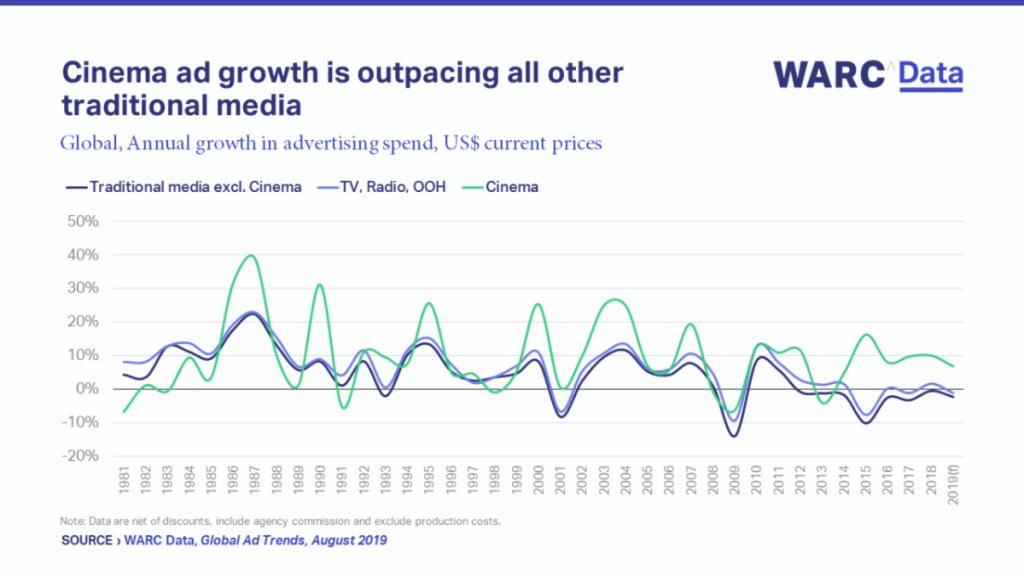

Cinema advertising growth is outpacing all other traditional media, as Netflix’s rise shows no notable impact

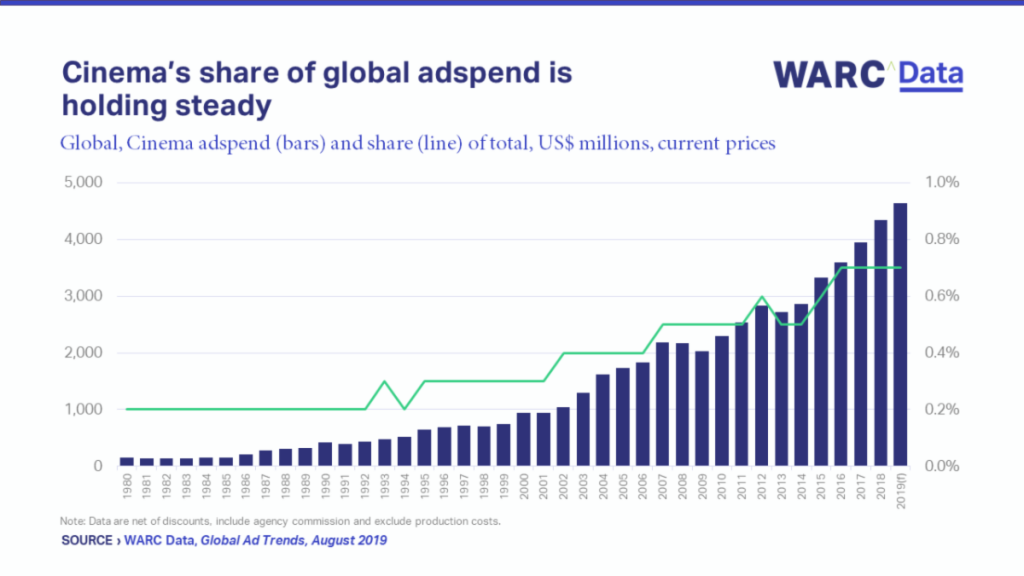

The global cinema advertising market is expected to be worth $4.6bn this year, representing a 6.8% rise from 2018. This is ahead of the all media growth forecast by WARC, the international marketing intelligence service, of 4.6% for 2019 (to $624.9bn), and places cinema as the second-fastest growing ad medium this year, behind internet as a whole.

Cinema’s share of global adspend is holding steady

While small, cinema’s 0.7% share of global adspend is expected to hold steady in 2019, making it the only medium other than internet not to lose share. Figures from WARC’s Adspend Database show that cinema’s share of global adspend has dipped only twice since 1980 (1994 and 2013) and growth in cinema ad investment has generally tracked ahead of other traditional media since 1981, and consistently so since 2014.

In Europe, advertisers spend 1.6 times more on cinema per admission than in the US. The UK leads the way, with spend per admission rising from £0.18 in 1980 to £1.43 last year, when 177m admissions were recorded – the highest on record. This despite 46% of UK consumers stating that Netflix is their first choice for watching movies, according to GlobalWebIndex.

China is driving global growth, US brands are under-investing

China is the largest cinema ad market globally, with RMB11.9bn (US$1.8bn) expected to be spent this year. This equates to a 47.3% share of global cinema adspend when measured in Purchasing Power Parity terms. Further, China has accounted for three quarters (74.9%) of global growth in cinema adspend since 2015, on average, and is expected to contribute 87.4% towards global cinema growth this year. IHS figures suggest that the number of cinema screens in China increased by 9,303 in 2018 alone, or 26 per day on average.

In the US, the world’s second-largest cinema market with a projected value of $735m this year, the medium draws less than half a percent (0.4%) of media budgets on average. Seven product categories allocate more than this, most notably food, for which cinema accounts for 1.5% of all media spend. Non-profit (1.0%), telecoms & utilities (0.7%), alcoholic drinks (0.7%), automotive (0.6%), transport & tourism (0.6%) and financial services (0.5%) also record investment levels above the US average.

DCM recommends that brands invest a minimum of 2.7% of budgets in cinema, with some sectors like travel & tourism seeing optimal levels of campaign ROI when allocating as much as 11%.

Attentive audiences ensure cinema ads get noticed in a brand-safe environment, while young audiences have a positive affinity with the medium

Captive audiences viewing high-quality ads in an emotional atmosphere is a draw for advertisers. Research by Ebiquity has found that Cinema outperforms all other media at triggering an emotional response, guaranteeing a safe environment, and getting ads noticed. However, the medium scores lowest in increasing campaign ROI, maximizing campaign reach, and generating short-term sales.

Cinema attracts a younger, more affluent audience who tend to be lighter TV viewers. According to IPA TouchPoints 6, cinema delivers a more positive emotional experience than any other AV channel (84% of time spent at the cinema is associated with positive emotions for 16+ adults, versus 60-65% for live TV, longform VOD and short online video). Kantar Millward Brown has also found that among ‘Gen Z’ (16-19 year-olds), cinema is the most popular traditional advertising medium with 59% feeling ‘positive about it’ (compared to 34% for print, 38% for TV and 50% for outdoor).

Consumers now spend more on streaming movies than visiting the cinema, but Netflix has yet to hit the box office

Data from the Motion Picture Association of America (MPAA) show that the amount consumers spend on digital home entertainment, including on online subscriptions such as Netflix, surpassed the amount spent at the cinema globally for the first-time last year ($42.6bn versus $41.1bn). This landmark had already been reached in the US during 2015.

Over the course of an average year, a Netflix subscription will cost a consumer US$113.16. This compares to the $45.55 a North American will spend at the cinema each year on average, with the equivalent figures for the UK and the EU at $25.13 and $11.04 respectively.

In the US, a moviegoer visited the cinema five times on average in 2018, which roughly equates to 263m consumers going every two months. But with almost three-quarters (74%) of Americans now using an online subscription – and 84% using a pay TV channel – to watch a movie at least 2-3 times each month, viewership in the living room may have reached parity with the silver screen.

James McDonald, Managing Editor, WARC Data, and author of the research, says: “The experiential nature of cinema places it in a different bracket to SVOD services, which instead occupy a similar space to traditional TV. This, coupled with the exclusivity of box office hits – particularly franchises – should ensure any downward pressure from SVOD services is minimal in the short term.

“Cinema offers advertisers access to younger, more affluent audiences who have an affinity with the medium. This enables ads to be screened in a brand safe environment where they will be noticed, often in a location that is close to a retail outlet and, by extension, a point of purchase.”

Global media analysis – Cinema

Other key media intelligence new on WARC Data

Global Ad Trends, a monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments, is part of WARC Data, a dedicated online service featuring current advertising benchmarks, forecasts, data points and trends in media investment and usage.

Download a sample report of WARC’s latest Global Ad Trends report on Cinema.

Source: WARC

Back in December 2017, Saudi Arabia announced the lift of a 35-year-old ban on commercial theaters as part of the country’s 2030 vision to modernize and move the country forward.

In April 2018, Saudi Arabia’s first cinema (operated by AMC Entertainment) was launched, followed by the launch of a 4 screen VOX Cinemas at Riyadh Park Mall –featuring an IMAX, 2 VOX Kids and 1 VIP screen.

As the official cinema advertising partner of VOX Cinemas, Motivate Val Morgan received an overwhelming response from advertisers within hours of the cinema chain launching in the Kingdom.

The first advertisers to book on-screen ads through Motivate Val Morgan at VOX Cinemas – Riyadh Park Mall were recognized and awarded certificates for embracing the medium and including cinema as part of their media mix in Saudi Arabia:

HotelsCombined

The First Advertiser in Saudi Arabia

Agency – Adcomm

Campaign Start Date – 10th May 2018

Campaign End Date – 04th July 2018

General Motors Overseas Distribution LLC for Chevrolet & GMC Yukon

The First Advertiser in the Automobile Category

Agency – Carat Middle East

Campaign Start Date – 10th May 2018

Campaign End Dates– 18th July 2018 (Chevrolet) and 04th July 2018 (GMC Yukon)

Emirates Airlines

The First Advertiser in the Airline Category

Agency – Havas Media Middle East

Campaign Start Date – 24th May 2018

Campaign End Date – 06th June 2018

Landmark Retail Investment for Homecentre

The First Advertiser in the Furniture and Furnishing Category

Agency – OMD KSA

Campaign Start Date – 24th May 2018

Campaign End Date – 06th June 2018

Tawuniya

The First Advertiser in the Insurance Provider Category

Agency – OMD KSA

Campaign Start Date – 07th June 2018

Campaign End Date – 01st August 2018

Richemont (Dubai) FZE for Cartier

The First Advertiser in the Luxury Jewellery Category

Agency – MediaCom UAE

Campaign Start Date – 14th June 2018

Campaign End Date – 20th June 2018

ADIDAS

The First Advertiser in the Sports Performance and Lifestyle Category

Agency – Spark Foundry MENA

Campaign Start Date – 14th June 2018

Campaign End Date – 08th August 2018

Huawei

The First Advertiser in the Mobile Category

Agency – Initiative Media ME

Campaign Start Date – 05th July 2018

Campaign End Date – 30th January 2019

NETFLIX for Sacred Games S1

The First Advertiser in the Entertainment on Demand Category

Agency – MEC KSA

Campaign Start Date – 05th July 2018

Campaign End Date – 18th July 2018

Majid Al Futtaim Properties LLC for MAF Properties Community

The First Advertiser in the Real Estate Category

Campaign Start Date – 24th May 2018

Campaign End Date – 18th July 2018

Dubai Corporation for Tourism & Commerce

The First Advertiser in the Tourism Category

Agency – Starcom UAE

Campaign Start Date – 02nd August 2018

Campaign End Date – 22nd August 2018

Binzagr CO-RO LTD for Suncola

The First Advertiser in the F&B Category

Agency – OMD KSA

Campaign Start Date – 30th August 2018

Campaign End Date – 03rd October 2018

Saudi Telecom Company (STC)

The First Advertiser in the Telecommunications Category

Agency – UM7

Campaign Start Date – 20th September 2018

Campaign End Date – 29th September 2018

Alshaya International Trading Company KSA for IHOP

The First Advertiser in the Restaurant and Café Category

Agency – BPG MAX

Campaign Start Date – 23rd September 2018

Campaign End Date – 29th September 2018

Toshiba

The First Advertiser in the Electronics Category

Agency – Equation Media

Campaign Start Date – 11th October 2018

Campaign End Date – 07th November 2018

Rado

The First Advertiser in the Watches Category

Agency – BPG MAX

Campaign Start Date – 15th November 2018

Campaign End Date – 12th December 2018

Glade Air Freshener

The First Advertiser in the Home Care Category

Agency – PHD

Campaign Start Date – 13th December 2018

Campaign End Date – 09th January 2019

The First Advertiser in the Technology Category

Agency – OMD

Campaign Start Date – 20th December 2018

Campaign End Date – 24th April 2019

Dubai Shopping Festival

The First Advertiser in the Events, Exhibitions & Conference Category

Agency – Starcom

Campaign Start Date – 20th December 2018

Campaign End Date – 16th January 2019

Olite & Afia International Company

The First Advertiser in the Healthy Cooking Oil Category

Agency – Starcom Jeddah

Campaign Start Date – 18th March 2019

Campaign End Date – 24th March 2019

Downy, P&G

The First Advertiser in the Fabric Softener Category

Agency – Starcom Jeddah

Campaign Start Date – 20th June 2019

Campaign End Date – 03rd July 2019

Motivate Val Morgan warmly congratulates the advertisers highlighted above, and encourage other advertisers in specific categories – who are yet to advertise on cinema screens in Saudi Arabia, to get in touch with a member of our sales team for more information on advertising opportunities.