Screenvision Media, in collaboration with Amplified Intelligence and MAGNA Global, has released a media study** providing compelling insights into the effectiveness of cinema advertising and its positive outcomes.

Jennifer Friedlander, Screenvision’s Senior Vice President of Insights and Measurement, explained the study’s dual objectives to Digital Cinema Report: “One was to capture and measure active attention to ads and content in the cinema environment. And two, we wanted to make sure that we had that cinema data available both for ourselves to share with our advertisers and for comparison to other media and also for agencies that are starting to actually plan and optimize against attention data.”

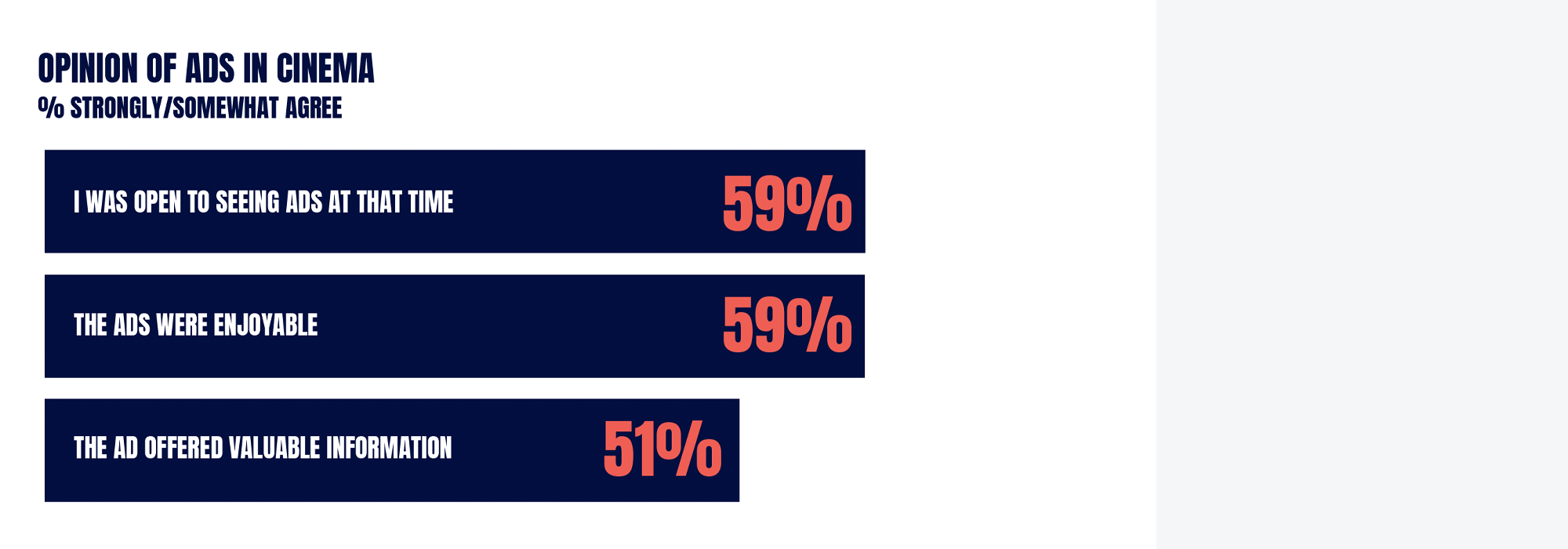

She added, “There is increasingly more evidence that attention drives outcomes across the industry. We have seen this in our own research with proven results on both short-term outcomes such as sales lift to more long-term outcomes such as brand choice and preference.”

Here are the ten findings of the study:

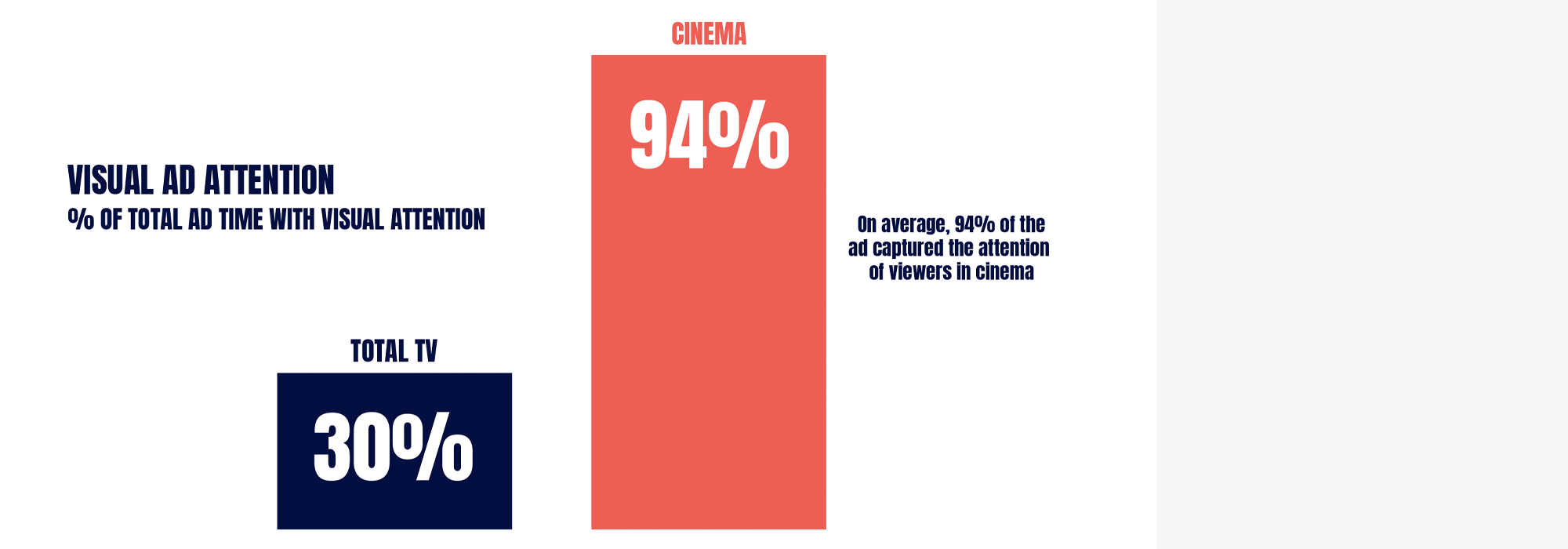

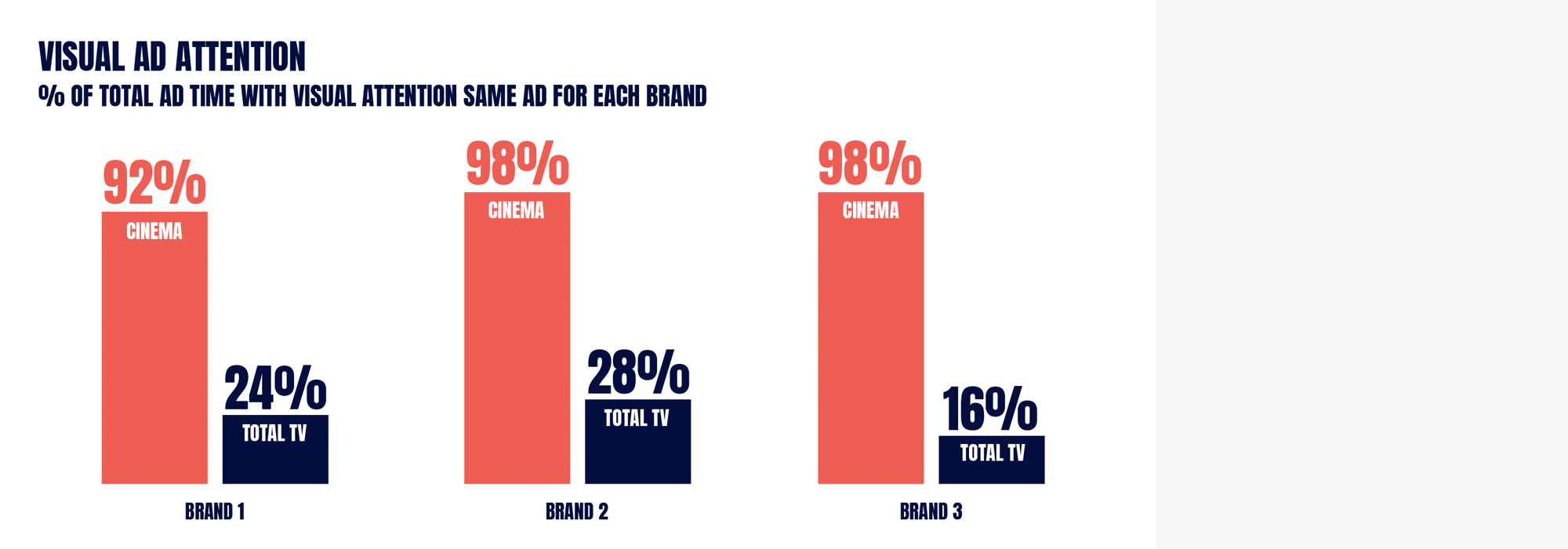

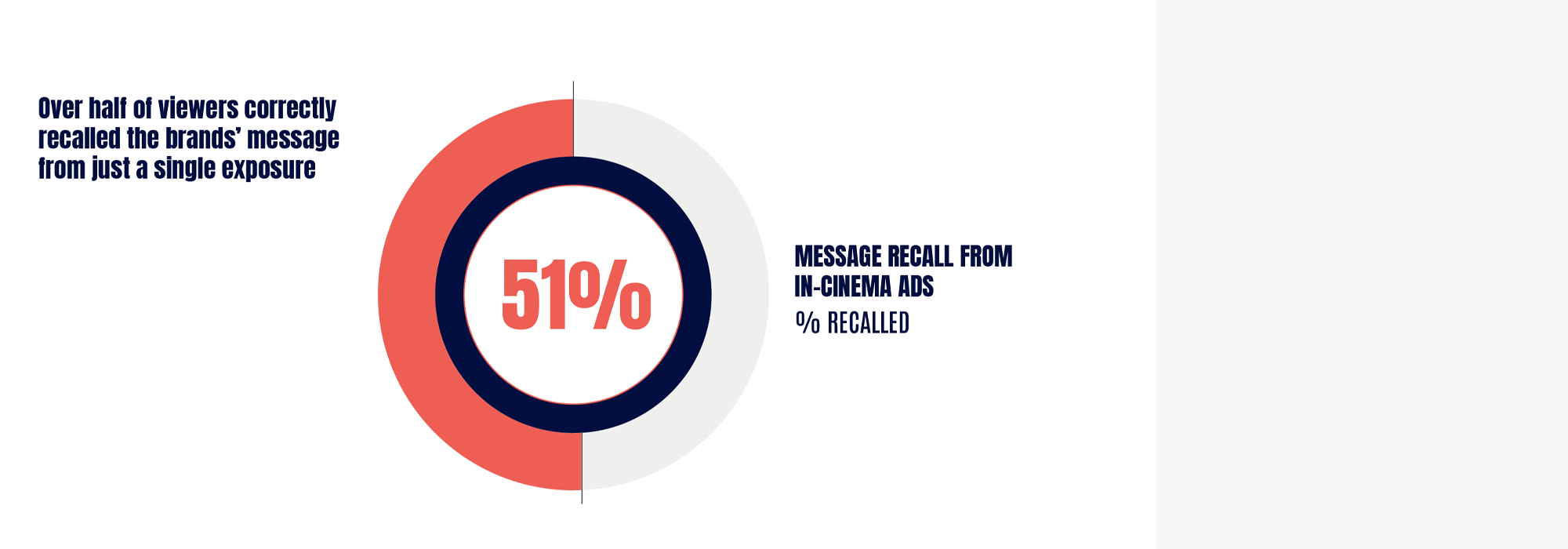

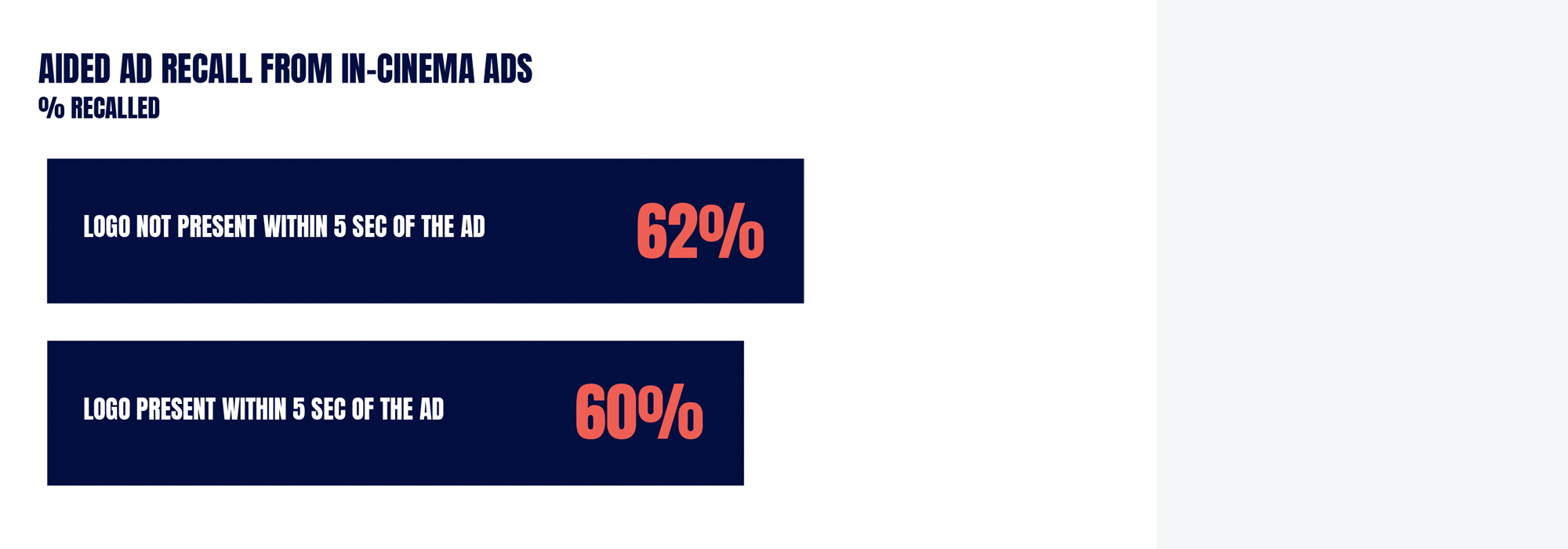

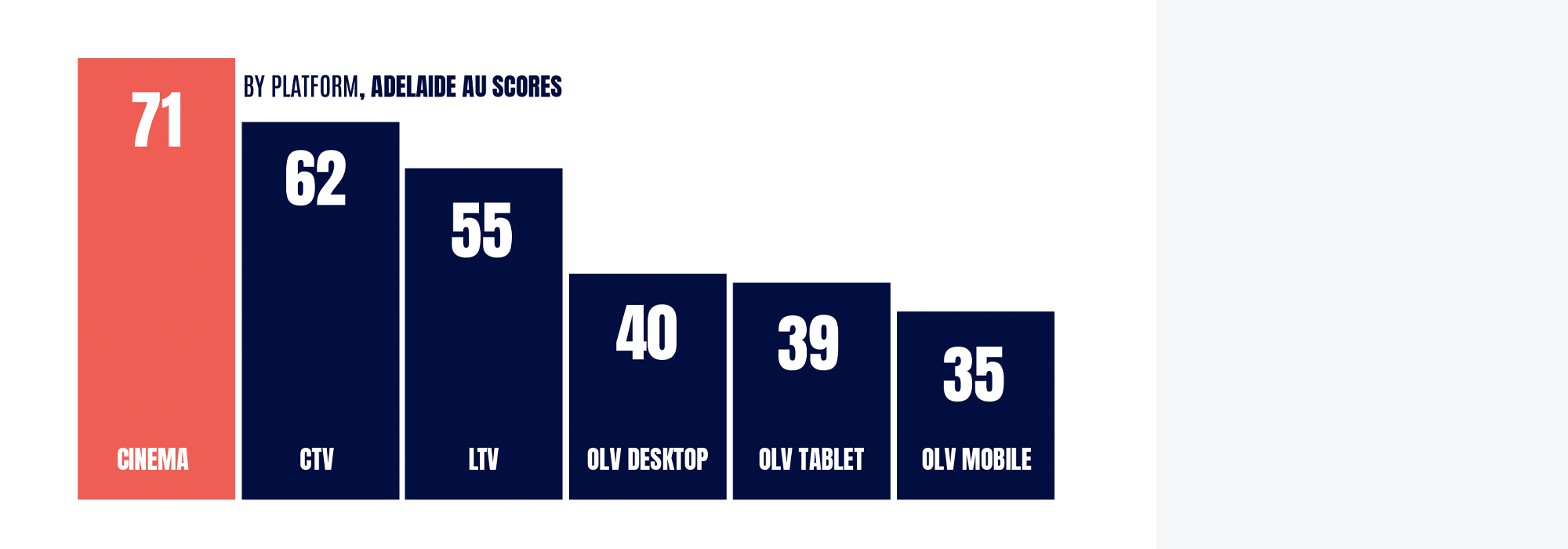

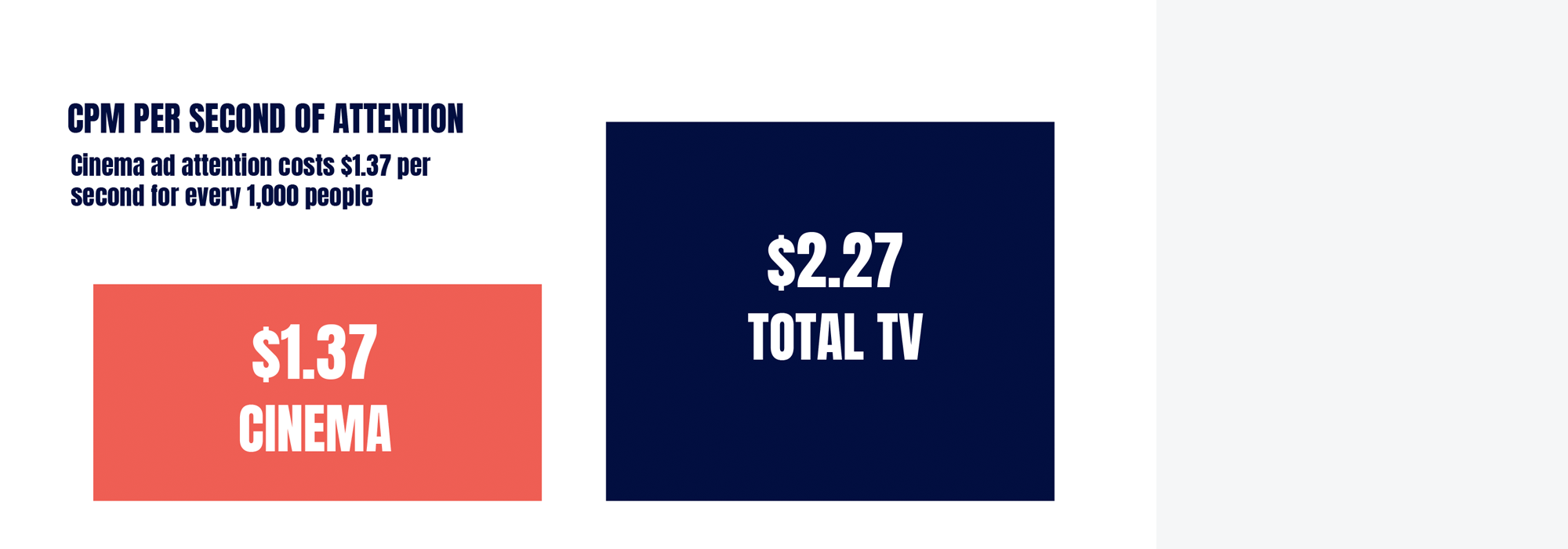

To conclude on key takeaways, cinema advertising offers brands the opportunity to achieve three times higher attention by employing the same TV creative in the cinema. Advertising in cinema drives memory: a single impression in cinema delivers brand and message recall, emphasizing the impact of each impression. It also provides brands with creative freedom in long-form storytelling, eliminating the need to follow specific branding rules required in other mediums such as digital.

Reading this together with the recent study by Fiftyfive5 on Brand Fame, where one cinema ad delivers ten times the brand fame over digital and six times over TV, makes it crystal clear that cinema is a powerhouse and must be included in every video mix.

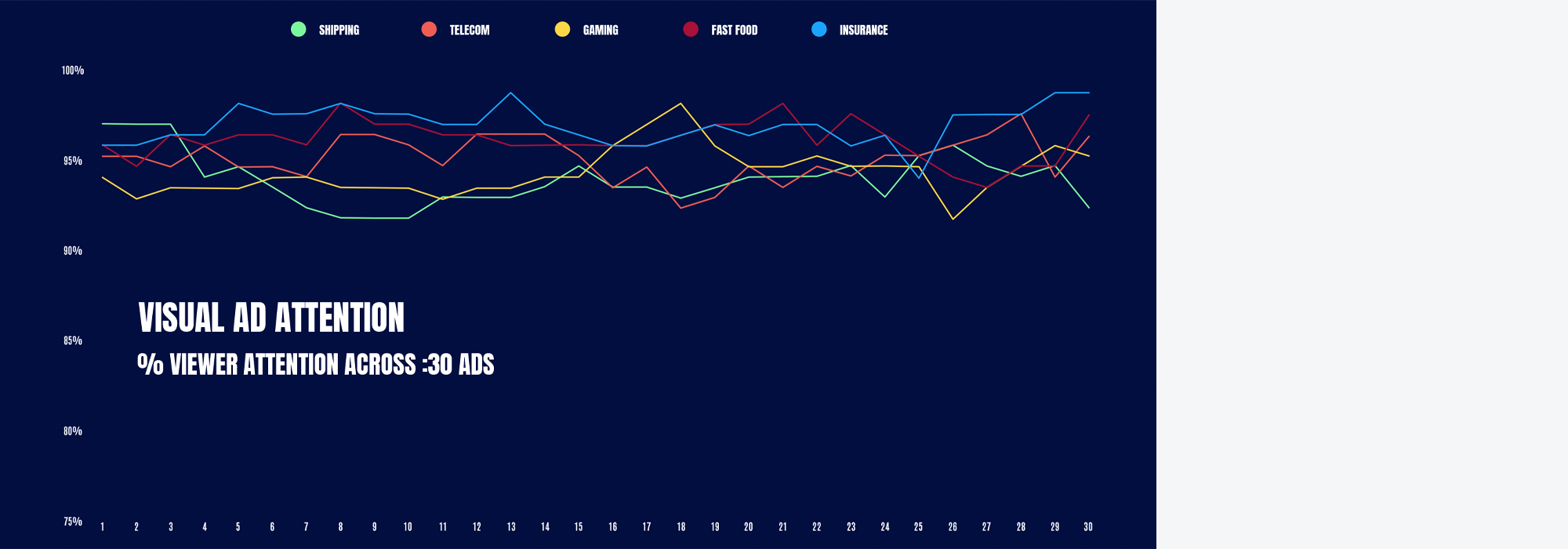

**Screenvision and Amplified Intelligence recruited 171 moviegoers (aged 18+) with their consent to be filmed entirely during a movie of their choice, without revealing the study’s purpose. This allowed participants to engage in their normal cinema-going activities with complete flexibility, such as enjoying snacks, leaving the theater, or using the bathroom. Eleven ads from various brand verticals, including automotive, entertainment, shipping, and telecom, were shown during the pre-show.

Sources:

Screen Vision, MAGNA global, SAWA, Digital Cinema Report

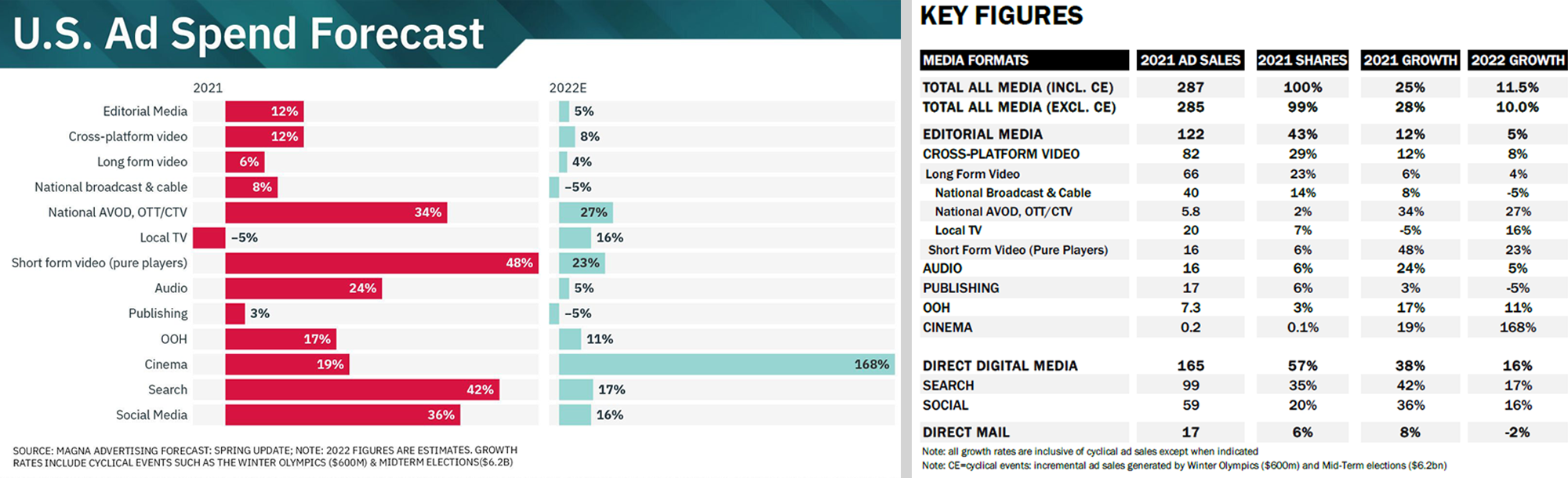

Cinema ad spend in the U.S is expected to grow by 168% in 2022.

The advertising industry was one of the most affected by the pandemic. 2021 however, witnessed a rapid bounce back, with most mediums reaching a record high and surpassing pre-pandemic levels.

In a recent study, Magna Advertising forecasted U.S. ad spend in 2022 for each medium, and while most mediums are expected to grow less in 2022 – a result of the doom-and-gloom narrative surrounding the ad market owing to the impending recession, ad spend on cinema is expected to increase by 168%.

Due to a disappointing first half in 2021, full-year ad sales amounted to just 24% of pre-COVID levels, however it is projected that cinema advertising will enjoy its first quasi-normal year since 2019, with audience admissions already witnessing a boost with the release of The Batman, Doctor Strange in the Multiverse of Madness and Top Gun: Maverick, and a large slate of blockbusters set to release over Q3 and Q4 2022: Jurassic World Dominion, Thor: Love and Thunder, Black Panther: Wakanda Forever, Black Adam and Avatar: The Way of Water.

As movie attendance is on the rise, marketers in both the U.S and globally are also looking at the ‘attention’ aspect cinema affords advertisers. Recent research by Amplified Intelligence reveals that cinema scores 80% ‘active’ attention and 20% ‘passive attention’ with zero wastage and no decay – the highest statistic thus far for active attention in a market of 30-40% attention average.

Sources: Magna Global, Variety and Mi3