Shah Rukh Khan-starring blockbuster Jawan garnered USD$78M worldwide in its opening weekend

Jawan, one of the most highly anticipated Bollywood movies of 2023 starring Shah Rukh Khan, has finally made its grand debut on the silver screen. The action thriller has shattered records, grossing over USD$78M worldwide in just one week and attracting over 440,000 cinemagoers in the Middle East.

With cinemas buzzing, renowned brands across the region seized this unique opportunity by securing on-screen advertising to establish connections with captive cinema audiences on the big screen.

From FMCG brands to real estate developers, and healthcare groups, here are the cinema campaigns booked to follow the action-thriller Jawan:

Gazebo Restaurant

Region: UAE

Duration: 30 Sec.

Prime Medical Center

Region: UAE

Duration: 15 Sec.

Everest Spices

Region: UAE

Duration: 35 & 40 Secs.

Bafleh Jewelery

Region: UAE

Duration: 30 Sec.

Jaguar World

Region: UAE

Duration: 30 Sec.

Absolute Barbecue

Region: UAE

Duration: 15 Sec.

Sushila Jewelers

Region: UAE

Duration: 15 Sec.

Meteora Developers

Region: UAE

Duration: 15 Sec.

Unilever – Glow & Lovely

Region: UAE

Duration: 10 Sec.

Unilever – Comfort Rinse

Region: UAE

Duration: 20 Sec.

Kaya Skin Clinic

Region: UAE

Duration: 15 Sec.

Ajmal Perfumes

Region: UAE

Duration: 15 Sec.

P&G – Ariel

Region: UAE

Duration: 20 Sec.

Bawree

Region: UAE

Duration: 30 Sec.

ITC

Region: UAE

Duration: 30 Sec.

Think cinema for ‘attention-grabbing’ advertising!

Check out the list of upcoming blockbusters in Q4 2023 and contact us for cinema advertising opportunities across the GCC, Egypt and Lebanon.

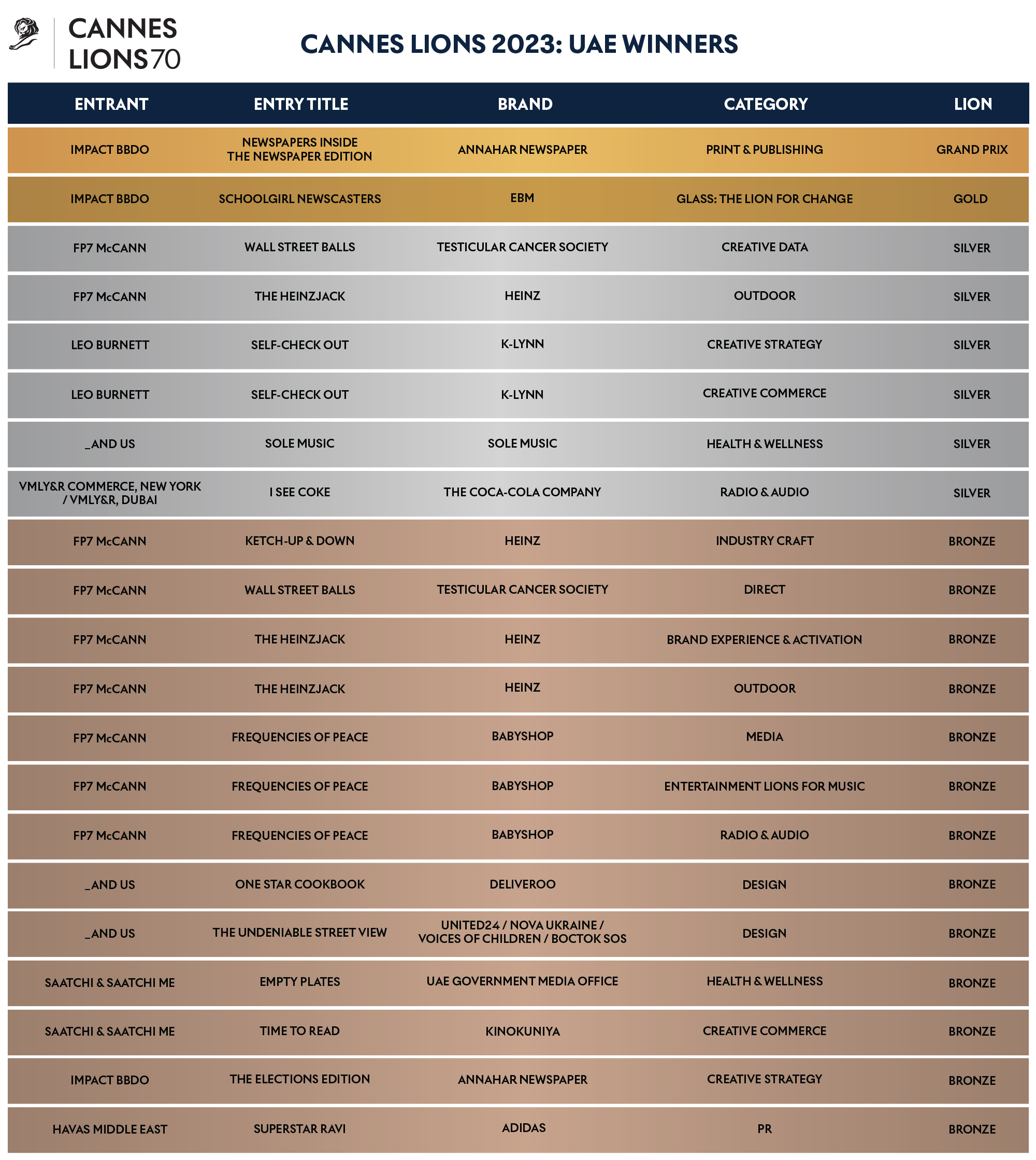

The United Arab Emirates wins 21 majestic Lions – 1 Grand Prix, 1 Gold, 6 Silver and 13 Bronze, at the 2023 Cannes Lions International Festival of Creativity.

The 70th edition of the prestigious Cannes Lions International Festival of Creativity drew to a close on 23rd June 2023, with the United Arab Emirates winning a total of 21 Lions – 1 Grand Prix, 1 Gold, 6 Silver and 13 Bronze, across multiple categories, including first-time wins in the categories of Glass: The Lion for Change, Entertainment for Music, and Creative Data. The UAE also amassed an impressive count of 89 shortlists, truly exemplifying its creative prowess on the global stage.

Winning agencies from the UAE include Impact BBDO Dubai, FP7 McCann, Leo Burnett, ‿ and us, VMLY&R, Saatchi & Saatchi ME and Havas Middle East. Their remarkable achievements serve as a testament to the thriving creative landscape within the UAE and the country’s capacity to compete at the forefront of the global advertising and marketing industry.

Philip Thomas, Chairman, LIONS, said, “The body of Lion-winning work that emerged from the Jury rooms points the way forward, and demonstrates the power of the industry to drive change, build businesses and shape society. Congratulations to all those who entered, who made the shortlists, and who won a Lion at the Festival’s 70th edition to set the creative benchmark on the global stage.”

The 70th edition of the Cannes Lions Festival also marked a significant milestone for the UAE, as it boasted the largest contingent of jurors to preside over a single festival. Notably, Ali Rez from Impact BBDO made history by becoming the first-ever Jury President from the MENA region, while Sandro Gelashvili from Google contributed as a jury member for the inaugural Entertainment Lions for Gaming category.

Symon Medeiros and Jonathan Cruz from ‿ and us, along with Chloe Salloum from the American University in Dubai, proudly represented the UAE in two esteemed events as part of the Festival: the International Young Lions Digital Competition (for young creatives under 30 in the digital category) and the Roger Hatchuel Academy (a mentorship program for university students in creative communications). Their participation exemplifies the UAE’s commitment to nurturing and empowering emerging talent in the ever-evolving creative landscape.

Commenting on their experience at this year’s Festival, Saymon and Jonathan from ‿ and us, expressed, “Attending Cannes Lions is always a fantastic experience. It’s a hub of creativity and inspiration where we can gain insights from the best ideas around the globe. Moreover, it’s an excellent opportunity to interact with past colleagues and connect with individuals we aspire to collaborate with in the future. This year, the Young Lions competition centered around Rocket Learning, a non-profit organization dedicated to helping young children prepare for school. We were given 24 hours to develop a digital solution for their brief. It was truly rewarding for us to utilize the power of creativity to assist them in solving real-world problems.”

Speaking about her experience at this year’s Roger Hatchuel Academy, Chloe Salloum from American University in Dubai said, “Representing the UAE at the Cannes Lions Roger Hatchuel Academy was a remarkable experience that exceeded all of my expectations. The week-long program has completely transformed my life and mindset, pushing me to embrace heightened creativity and purpose in my work. Beyond the educational aspect, I had the privilege of forging deep connections and friendships with my fellow Roger Hatchuel Academy graduates. As a member of SheSays Dubai, I was thrilled to learn that 80% of the academy members were women! That is a true testament to the brilliance of women in this industry, and I was ecstatic to be a part of it.”

She further added, “I want to thank my professor, Dina Faour, who has been the driving force behind all of this. I am grateful to American University in Dubai for providing me with the academic knowledge and professional exposure I need to start my career. Lastly, I would like to express my gratitude to the Motivate Val Morgan team, especially Dumindrini Ratnayake, for her professional guidance and support throughout the entire Roger Hatchuel Academy experience. The program has left a special mark on my heart, and I am eager to utilize the invaluable insights I have gained to contribute to the dynamic advertising industry in the UAE.”

As the official representatives of the Cannes Lions International Festival of Creativity in the UAE, Motivate Media Group and Motivate Val Morgan extend heartfelt congratulations to the victorious agencies, esteemed jury members, and talented young representatives who proudly showcased the UAE at this year’s Cannes Lions International Festival of Creativity.

Sources: Cannes Lions ‘The Work’

L’Oréal booked an integrated cinema campaign with Motivate Val Morgan – through, Universal Media to promote their extended brand offering – Armani Code by Giorgio Armani.

Actor Regé-Jean Page embodies the modern, forward-looking rendition of masculinity that sits at the heart of the Armani Code philosophy.

The 15 sec. on-screen commercial was booked as a sponsorship spot at VOX Cinemas – Kingdom Centre Riyadh – KSA for a period of 4 weeks starting 10th November, coinciding with the release of Marvel’s blockbuster Black Panther: Wakanda Forever.

The off-screen component included a sampling activity prior to the screening of Black Panther: Wakanda Forever at VOX – Kingdom Centre Riyadh on the weekend of November 10th – 12th, 2022.

Perfume samples were placed on the seats, along with an Armani Code flyer, featuring Regé-Jean Page, and a QR Code for the audience to scan and order the perfume online.

Combining on-screen advertising with sampling at the cinema is an effective strategy when seeking to engage audiences with a new product.

Got a product launch ahead? Contact us to know more on how integrated campaigns can help move your brand closer to its target audience.

Motivate Val Morgan, in collaboration with VOX Cinemas, hosted a private screening of the Egyptian movie Tahit Tahdid Alsilah for our valued advertisers.

The screening took place on 3 November 2022 at 7:00 PM (local time) in the UAE – Mall of the Emirates, Oman – Muscat City Center, Bahrain – The Avenues, and Qatar – Doha Festival City.

With an attendance of over 220+ invitees across the four countries – a mix of agency and direct clients (and their friends/family members), the screening was a massive success!

We would like to take this opportunity to sincerely thank VOX Cinemas for helping us organize and execute the four private screenings of Tahit Tahdid Alsilah, and to everyone who attended the event, thus contributing to its immense success.

The newly launched platform has the capability to offer data and insight driven audience based cinema buying across Motivate Val Morgan’s network of cinemas in the Middle East.

Motivate Val Morgan, the leading cinema advertising company in the Middle East has launched a dedicated platform – CinePlan and CineMeasure, through which advertisers can plan and measure their cinema campaigns with ease.

CinePlan is a tool that can be utilized to build a cinema media plan based on advertiser requirements, and offers two routes: By Admission and By Package. The By Package route presents advertisers with the option to book existing pre-designed packages sold by Motivate Val Morgan, while the By Admission route is a new extension to the existing bouquet of cinema advertising offerings, where advertisers can define their advertising reach at cinema locations of preference.

CineMeasure is a post campaign measurement tool that works seamlessly with CinePlan to analyze and report admission data for an executed campaign.

Ian Fairservice, Managing Partner, Motivate Media Group, said, “As the region’s leading cinema advertising company, with over twenty-three years of regional experience, we are committed to constantly improve and innovate our offerings. The launch of CinePlan and CineMeasure marks a significant milestone for Motivate Val Morgan, as it establishes a first-to-market platform through a self-service model, a major focus for the company as we look to empower advertisers and provide autonomous cinema planning and measurement.”

The platform will add exceptional value for advertisers as it has the capability to offer data and insight driven audience-based buying across Motivate Val Morgan’s network of cinemas in the region, improving accountability and transparency to address concerns on cinema audience measurement, a byproduct of the pandemic.

Avinash Udeshi, Chief Operating Officer, Motivate Val Morgan commented, “While being a market leader, we have always had a consultative approach in terms of buying and delivering on campaign objectives. Through this platform, we will offer the same total flexibility and convenience to advertisers and agency planners, with admission data from the cinema box office. Thus, cinema advertising can now be further planned, bought, and measured through a simple yet comprehensive dashboard. The system has the capability to buy audience by numbers, demography, and income groups, right down to a granular level of an individual screen at a particular location.”

Advertisers can leverage CinePlan and CineMeasure to connect the dots between ad exposure and a campaign’s outcome.

Promo/Launch Video:

Visit: Motivate Val Morgan to start planning your cinema advertising campaign.

There has been a rapid increase of investment by advertisers in cinema advertising, the luxury brands are not far off.

Today, there are countless of options for luxury brands to tell their stories. To choose the right platform, advertisers need to tap into the consumers cluttered mind, which is exposed to advertisements on a daily. One way to ensure that the brand breaks through this clutter is by raising the intimacy the consumer shares with the brand.

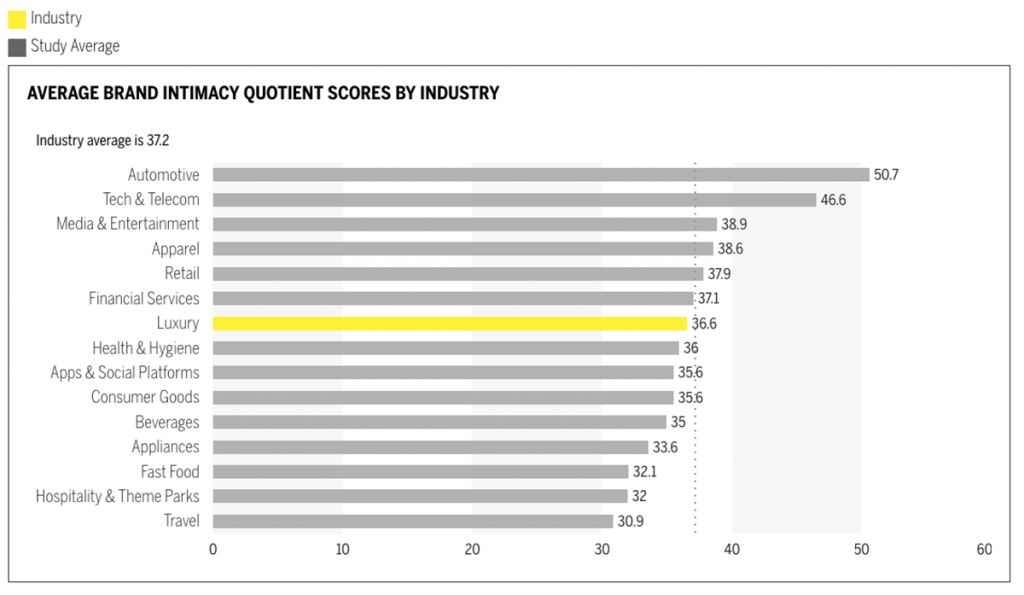

Important findings from the latest 2019 Brand Intimacy Report by MBLM and attributes of cinema advertising which help build Brand Intimacy among cinemagoers, gain a better understanding of ‘Brand Intimacy’ and more.

Understanding Brand Intimacy

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. These bonds are reciprocal and are fueled by emotion. Brands that build stronger bonds create stronger business return and longevity.

According to the 2019 Brand Intimacy Report, consumers are more willing to pay price premiums for Intimate Brands and less willing to live without them.

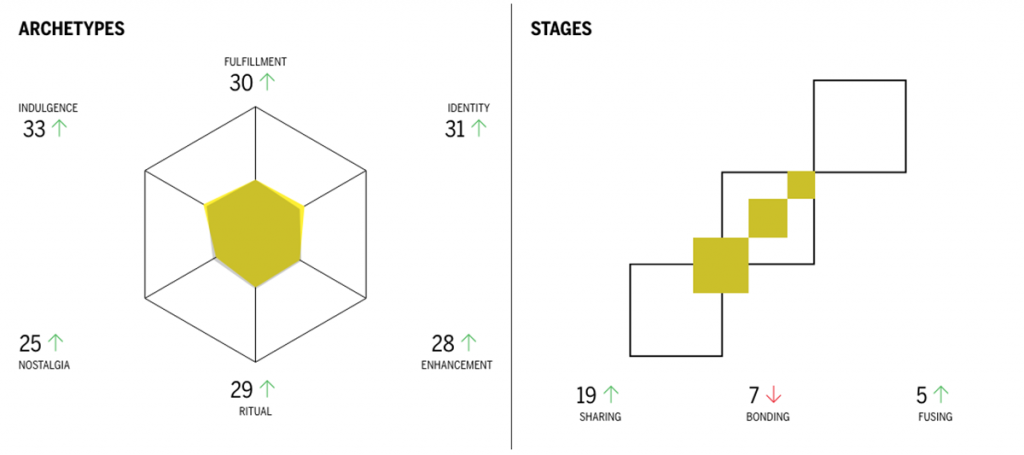

“Brands in the luxury category rely on creating, sustaining and developing stronger emotional relationships with their consumers. We’ve seen a tremendous increase in the industry around the enhancement and ritual archetypes, indicating that their consumers are changing their relationship to brands in the luxury category,” states William Shintani, managing partner of MBLM.

Latest MBLM Report 2019:

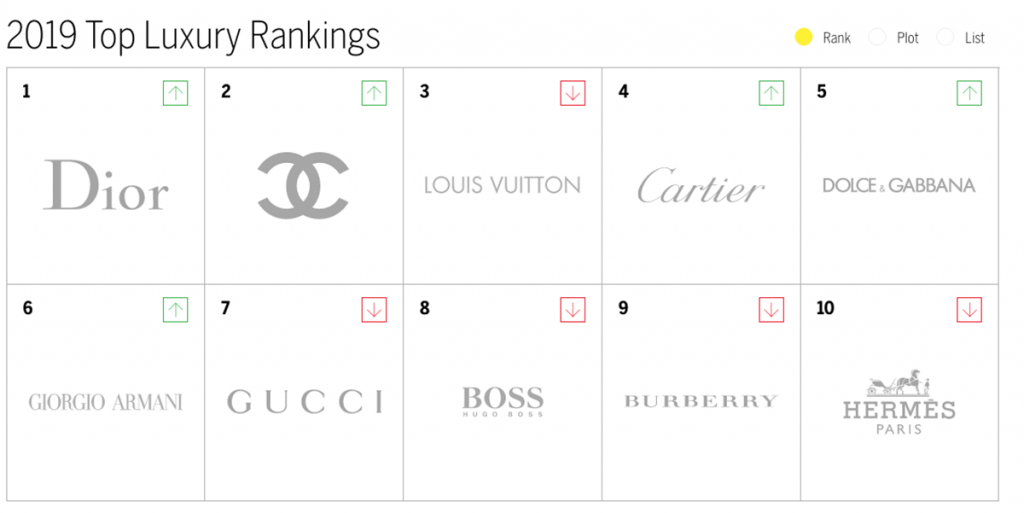

In 2019, the luxury industry remains in the 7th rank out of the 15 industries showcased in the 2019 Brand Intimacy Report.

Dior rises to the top of the luxury industry, followed by Chanel at #2 and Louis Vuitton at #3. The Top 10 is rounded out by Cartier, Dolce & Gabbana, Armani, Gucci, HugoBoss, Burberry, and Hermès respectively.

Enhancement and Nostalgia are fastest growing archetypes (the type of emotional relationship between a person and a brand) in the luxury category.

31% of users report being in one of the three stages of intimacy (sharing, bonding and fusing) with the luxury industry.

Notable findings for the luxury industry include:

MBLM leverages the yearly study to help advertisers create, sustain and measure ultimate brand relationships. To download the full Brand Intimacy 2019 Report, please click here

Attributes of Cinema to Build Brand Intimacy

Cinema has the strongest combined brand impact of any medium, according to research by Millward Brown, commissioned by Digital Cinema Media.

Millward Brown brought together the combined learnings of 183 CrossMedia case studies from across Europe, 88 of which were in the UK, and examined how each medium performed against five metrics.

Pound-for-pound, cinema outperformed all of the other media in all but one of the five metrics.

Why choose cinema as a medium for advertising?

Cinema is the strongest medium for making brands memorable with a return of investment (ROI) of 2.9 per cent, ahead of TV with an ROI of 2.5 per cent.

Cinemas deliver greater recall and resonance for audiences than any other AV channel, now is a better time than ever for marketers to invest in cinema advertising to build their brands.

Ideal Environment for Advertising

Dark Auditorium & Distraction Free – All eyes on the big-screen and attention guaranteed without interruptions.

Everything About it is BIG

Larger Than Life Image – Consumers notice cinema ads as they make real use of the big screen with impressive graphics, panoramic landscapes and unusual visual displays.

Exceptional Audio

Surround Sound & Booming Bass – Sound is a key part of the cinema experience, with the best ads using it to optimize its effect.

Captive & Receptive Audience

“Opt in” Medium – With the audience choosing to go to the cinema, your brand reaches out to a relaxed and receptive audience.

In addition, cinema offers 360-degree exposure and innovative opportunities to brands – utilizing both on-screen and off-screen advertising. Ranging from sampling, activations, promotions and many more activities, advertisers can now compliment and support their on-screen ads with off-screen advertising for greater brand impact.

The tendency of people towards cinemas is increasing day by day. According to a survey, since 2008, the total number of people visiting cinemas increased by 24 percent, with 75 percent of the adult population. During the shows, with an excess of 87 percent of moviegoers exposed to the ads, cinema’s appeal is continually reaching to more and more people which provides a powerful way for advertisers to reach audiences.

Target luxury niche audiences using Cinema

With an increase in the number of blockbusters releasing across the region and an equal increase in the number of cinema admissions each year, there’s no doubt that cinema remains an important platform for entertainment – catering to all ages and nationalities, and advertising in the region.

Luxury cinema concepts are very high-end and upscale – designated plush lobby areas, comfortable leather reclining seats, bespoke F&B offerings and a personalized waiter service, which elevates the movie going experience for consumers with a sophisticated mindset.

Such cinemas create small, intimate and curated relationships with sophisticated audiences which are more viable for luxury brands than mass awareness-seeking media campaigns.

Brand Storytelling is increasingly becoming the new way to create meaningful dialogs with luxury consumers – and there’s no better place than cinema for showcasing such content.

Luxury cinema concepts are no longer specific to certain operators. Today, most reputed cinema operator across the region offer unique luxury cinema experiences – catering to audiences of varying levels of sophistication.

Over the last two years, cinema operators have invested a great deal on expanding and upgrading their respective cinema multiplexes. From luxury cinema screens, to cinemas designed focusing on the little ones, the cinemas are now catering to a variety of demographics than ever before.

This upgrade includes the revamp of existing luxury cinema screens and the introduction of luxury cinema concepts and stand-alone boutique cinemas.

Luxury cinemas are intimate and private with fully reclining armchairs and adjustable footrests arranged in pairs with their own private table. The seating is tiered for unobstructed viewing.

The sheer opulence and indulgence of these luxury cinemas also offers unsurpassed levels of service. Drinks and snacks are served on-demand throughout the movie and the menu offers a range of premium food options.

An exclusive lounge facility is adjacent to each of these luxury cinemas – to deliver an intimate cinema experience for guests.

Motivate Val Morgan serviced cinemas that offer luxury cinema experiences include: VOX Cinemas (regionally), Reel Cinemas (UAE), Oscar Cinema (UAE), Cine Royal Cinema (UAE) and Cinemacity (UAE).

Partnering with the late celebrity Michelin star chef Gary Rhodes, VOX Cinemas introduced a new luxury THEATRE by Rhodes – the first concept of its kind in the Middle East in September 2015 at its Mall of the Emirates cinema location.

THEATRE by Rhodes delivers the most innovative and customer-focused experience, presenting movie lovers with a full food and beverage menu –prepared by in house chefs who are all trained to meet the internationally renowned Rhodes’ standard.

From a state-of-the-art auditorium to the large leather reclining pod-seats, waiter service and exclusive lounge, THEATRE by Rhodes is luxury cranked up to the max – effectively an upgrade on the VOX Gold Class cinema experience.

THEATRE by Rhodes is solely available at VOX Cinemas: Mall of the Emirates (UAE – Dubai), Yas Mall (UAE -Abu Dhabi) Nation Towers (UAE -Abu Dhabi), Doha Festival City (Qatar) and The Avenues (Bahrain).

Example Luxury Brand Cinema On-Screen Campaigns Booked Through Motivate Val Morgan:

Cartier

Tiffany & Co.

Tag Heuer

Why choose to partner with Motivate Val Morgan:

Motivate Val Morgan’s coverage includes over 480 cinema screens across 55 cinema locations in the Middle East – UAE, Lebanon, Oman, Egypt, Qatar, Bahrain, Saudi Arabia and Kuwait. We partner with leading cinema operators who offer luxury cinema experiences and have a presence in the best shopping malls across the region.

With an incredible slate of content coming to the big screen in 2020, cinema is set to once again appeal to a wide range of demographics.

Contact a member from our sales team for more information on cinema advertising opportunities that target affluent and sophisticated audiences.

Sources: Aviamost, Forbes, CampaignLive

Cinema is appealing to a more diverse group of consumers than ever before, making it an attractive platform for many brands to utilize. In order to ensure brands reach and engage their target audience effectively with their cinema promotion, there are certain consumer trends to be kept in mind, considering their potential impact on the outcome of a campaign.

The following article was published on LinkedIn by Casey Story – Organization Development Professional | Learning & Development Specialist | Sales Trainer & Coach

Kurt Wagner from Recode Media wrote an article stating that, “2019 will mark the first-time digital ad spend in the US outpaces TV and print combined.” Marketers will attest to this trend as there is a noticeable change in expectations among clients. Media planning conversations use to focus mostly around aspects including: Audience, engagement, reach, recall, like-ability, however the stakes have been shifting since 2008. Which most will remember as the year we all started walking around with cash registers in our pockets (personal smartphones).

Shifting of expectations from brands are steering agencies and media sales professionals to steer towards a ‘Positive Business Outcome’ approach to their media strategy. These teams are now focused on identifying the right consumers, reaching them in the right environment, engaging with them at the right time, and on the right devices to achieve and prove delivery of the KPI’s set forth by their clients.

While digital advertising allows brands to achieve several of these key components in the new outcome-based approach to planning, there are several considerations including: identifying the right consumers, reaching them in the right environment and engaging with them at the right time, that must still be supported by other channels in the traditional media space.

The following are three US consumer trends in 2019/2020 that make cinema advertising a more viable channel than ever to support brand goals:

Subscription Movie Going is Still Alive

Similar to blockbuster, taxi services and the music industry, the movie going industry did not feel a major disruption of their consumer’s expectations for a long period of time. The model was straightforward: negotiate with studios to fill theaters and auditoriums with blockbuster hits, sell tickets and concessions, invest in capital improvements that enhance the overall experience if/when needed. The main purpose was that the content on screen should be enough to encourage consumers to spend $10-20 dollars per ticket to see the films. Here’s where MoviePass makes its entrance.

The long-term arithmetic reflected in MoviePass’ model made it clear that without improved compensation from the circuits, the company was working on both borrowed time and money. As we know, the negotiation never happened, and MoviePass has been written down by its holding company.

The low-cost subscription model that MoviePass introduced however dramatically changed the consumer expectation regarding the cost of going to the movies. For the first time in years the exhibitors (Cinemark, Regal, AMC) have had to adjust their pricing strategy and are introducing subscription plans of their own. These actions have been well received by consumers. AMC recently announced that since launching their Stubbs A-List program (a $19.95 monthly subscription) in June of 2018, they have enrolled over 700,000 members.

This trend is important for advertisers considering cinema campaigns, because the data shows that when consumers have access to lower priced movie tickets, they see more movies. In the same article published in Variety, AMC noted that Stubbs A-List members had accounted for over 14 million movie ticket sales in the same amount of time.

Cinemark, Regal, and regional affiliates throughout the US are all working to finalize or develop their own subscription-based models to adapt to this shift in consumer expectation. What this means for advertisers is that passionate movie goers, those same consumers that drive 73% of spending in the US will be coming out in record numbers to their local movie theaters throughout 2019 because for the first time in years, they have a more affordable way of doing so.

Hollywood’s Franchise Era

The question, “When will Hollywood introduce us to new stories?” often rings in the minds of movie-goers alike. Ben Fritz’s book The Big Picture – The Fight for the Future of Movies answers this and discusses Hollywood’s shift towards the ‘franchise movie model’.

The reality is most consumers want two things when they choose to go to the movies:

Consumers may argue that they would prefer more adult dramas, romantic comedies, horror films, etc. However, the facts (historical ticket sales), reveal otherwise.

Looking at 2019’s slate of films, it is safe to say that we are in the heart of the Hollywood franchise era. The opportunities to experience something larger than life and culturally relevant are already driving record box office sales.

Captain Marvel (2019) made a total of $1,126,129,839 at the Worldwide Box Office. While remakes of popular Disney classics have been making cinema rounds. Classics such as: Dumbo made a total of $347,866,307 since its release in March 2019. Cinema-goers have also witnessed a rise in live-action remakes of popular Disney films this year, with movies such as The Lion King which made a whooping $1,638,761,919 at the box-office (to date). Whereas, the live-action version Aladdin’s live action version made a total of $1,037,017,346 since its release in May 2019.

From the Marvel Universe, the concluding film of the franchise- Avengers: End Game broke records at the box-office banking a total of$2,795,473,000 and continued to run in cinemas for 20 weeks across cinemas in the US.

The last quarter of the year holds great promise for the box office with mega sequels such as Frozen II, Jumanji: The Next Level and the concluding film of the Star Wars series: Star Wars: The Rise of Skywalker soon to release across cinemas worldwide.

Advertisers considering cinema campaigns should look closely at the historical success of the franchise model in domestic ticket sales. In the last four years, the highest grossing movies yearly in the US have come from within a franchise. This trend appears to continue throughout 2019. With the increased occurrence that moviegoers will be visiting theaters due to: Lower priced subscription service tickets and quality of content, advertisers have a unique opportunity to extend their reach among this audience year round.

Content Marketing: A Driving Force for Customer Connections

As digital spending eclipses traditional media spend this year, the digital marketplace has certainly become increasingly noisy. When adopting a positive business outcome marketing strategy, the goal is less about a brand’s ability to yell louder and more often than their competition. The goal, hence must shift, and brands must identify innovative ways to engage with their audience in an authentic manner, a trend that is leading the shift toward content marketing.

There are generally two approaches to developing a content marketing strategy:

When a brand has done well adopting either strategy, they pull their audience to their message instead of simply pushing more content into an already crowded marketplace. The impressions delivered from a content marketing strategy are much more valuable because customers actively seek out the content and actively share the message to other, like-minded, potential consumers.

Cinema is one of the last channels available for brands to tell an authentic story, at scale, in an environment with no ad skipping devices, and in front of consumers looking to be entertained.

Content marketing pieces delivered in this environment cut through the noise. Campaigns resonate with consumers, and the transparency of the cinema platform provides piece of mind for brands seeking to reclaim bot served impressions and eliminate wastage of advertising resources.

Are these trends similar in the Middle East?

Movie Ticket Offers

Leading cinema chains in the Middle East have tied up with mobile network providers (Example – du and Etisalat in UAE), offering cinemagoers to buy one movie ticket and get the other free. Similarly, numerous banks also provide customers a range of Debit and Credit card offers to availing movie-ticket and/or a free upgrade on the size of popcorn and beverages at the candy counter. Certain bank cards also offer moviegoers a buy 1 get one get one free movie ticket deal.

Such offers affirm the fact that when consumers have access to lower priced movie tickets, the frequency of cinema visits increase.

Love for Franchise Films

The craze among movie-goers for popular franchise films isn’t limited to the United States alone. Cinema statistics in the Middle East reveal the love and commitment among movie-goers in the region.

Following are statistics of UAE admissions for MEGA blockbuster franchise films:

Captain Marvel (2019)

Ran for 12 weeks and did over 425K admissions

Dumbo (2019)

Ran for 12 weeks and did over 180K admissions

The Lion King (2019)

Did over 697K admissions in the first 8 weeks since release

*The movie is still screening across select cinemas in the UAE

Avengers: End Game (2019)

Ran for 15 weeks and did over 848K admissions

Cinema Experiences like Never Before

A number of cinema chains in the Middle East offer unique cinema experiences – thus catering to the increasing demand by cinemagoers to watch movies like never-seen before. Audiences can now enjoy the latest blockbusters on mega screens such as IMAX, MAX, Dolby Cinema, nibble on gourmet delights at Dine-in Cinemas or opt for a luxury experience such as Gold by Rhodes, Theatre by Rhodes and Platinum Suites, while lounging in a comfy reclining seats, or dive into action on with 4DX and ScreenX.

VOX Cinemas recently launched a concept of ‘Distraction- Free Cinema’ to ensure cinemagoers immerse themselves entirely in the cinematic experience by tuning out all the distractions from theatres which include: no use of mobile phones or smartwatches, no late arrivals and no guests under the age of 18. Ninja-like staff are on surveillance inside the cinema throughout the screening.

In summary….

As price discovery, consumer targeting capabilities continue to improve the effectiveness of a brand’s digital execution, it’s important for marketers to identify the channels that allow them to reach a brand’s right consumer, in the right environment, at the right time, with a creative and authentic message.

Based on the forecast of movies, the trends in consumer behavior, and a shift in how brands are building relationships with their audience, there has never been a better time to double down in the cinema space.

Source: LinkedIn, Vox.com, AdAge, The Numbers, MVM Statistics

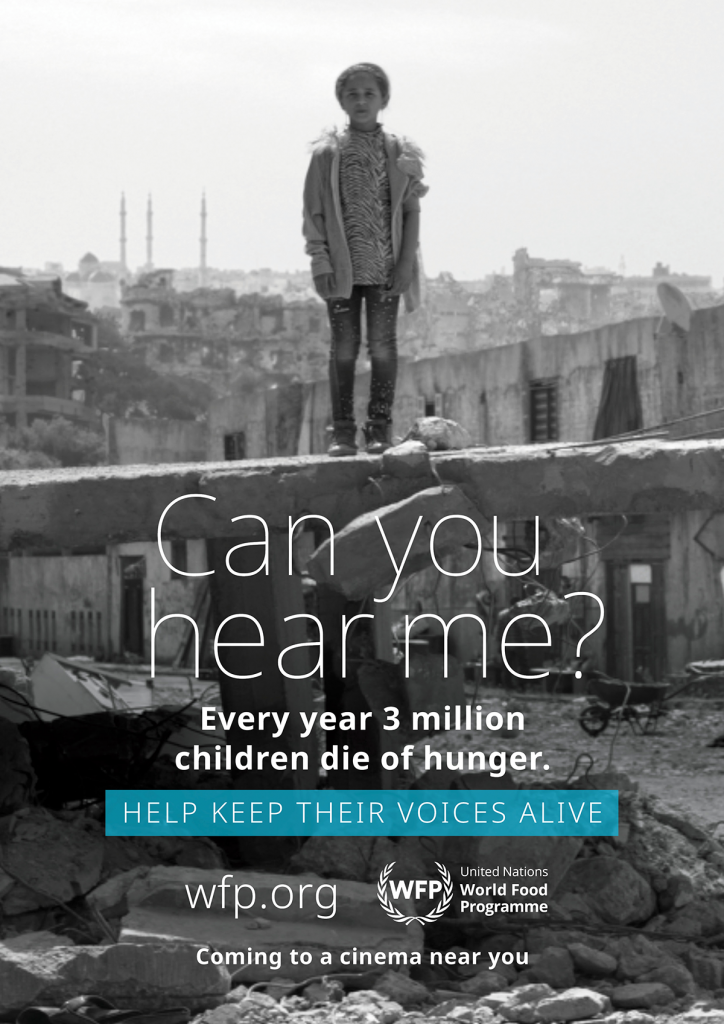

The UN World Food Programme partners with SAWA for yet another global cinema campaign to keep the voice of millions of children alive.

Motivate Val Morgan has joined the next phase of “Feed our Future”, a global cinema campaign that shines light on the United Nations World Food Programme’s (WFP) life-saving work on the frontlines of world hunger.

The ad started screening on Thursday 26th September 2019 across 19 Motivate Val Morgan serviced VOX Cinemas locations in UAE, Qatar and Bahrain, and will run for a period of 8 weeks.

UAE:

Marina Mall (Abu Dhabi), Yas Mall (Abu Dhabi), Nation Towers (Abu Dhabi), Abu Dhabi Mall, Al Jimi Mall, City Centre Ajman, City Centre Sharjah, City Centre Fujairah, Al Hamra Mall (Ras Al Khaimah), City Centre Deira, City Centre Mirdif, Mall of the Emirates, Mercato Mall, Burjuman, Cineplex Grand Hyatt, City Centre Shindagha and Aloft City Centre Deira

Qatar:

Doha Festival City

Bahrain:

The Avenues

Motivate Val Morgan supports the “Feed our Future” cinema campaign as part of a unique partnership between SAWA – Global Cinema Advertising Association, and WFP – leading humanitarian agency fighting hunger worldwide.

The new campaign aims to build on last year’s results that helped to double awareness of WFP among those who saw the ad and raised more than half a million dollars through online giving or through a 38% increase in downloads of the agency’s Share the Meal donation App, globally.

“We have every reason to believe that this year, the Feed our Future campaign is going to take us even further in terms of raising WFP brand visibility and engaging a wider audience in the fight against global hunger,” said Corinne Woods, Chief Marketing Officer at WFP. “We think that this year’s campaign is even more emotionally engaging and we expect more people will respond to our call. In a world full of noise, cinema has proven incredibly effective for us at cutting through to not only establish our brand, but also to convert cinema goers into active supporters and donors.”

“The Cinema Medium makes the most of its space, creative and audience to deliver gripping content, showing consumers advertising at its very best,” said Cheryl Wannell, CEO of SAWA. “In 2020 the Cinema Medium is predicted to become the fastest-growing ad medium ahead of the internet. For brands like the World Food Programme who want to reach the hearts and minds of millennials, the immersive experience that Cinema gives is the most powerful of all storytelling mediums.”

The creative force behind the new advertisement is Sir John Hegarty, of The Garage SOHO, who has delivered a product designed to appeal directly to cinema audiences. The advert highlights the potential lost to the world when children’s voices are silenced due to hunger. The poignant narrative of the ad sees a group of Syrian refugee children who were selected from the local community playing in rubble and gazing out of bombed-out buildings in an apparent war zone. Softly, a small chorus of voices begins singing “How Can I Tell You” by Yusuf Islam/Cat Stevens. As the short film progresses, one by one these children disappear until only one voice remains — an unnerving conclusion that mirrors the harsh realities faced by the 3 million children around the world who lose their lives to hunger or malnutrition.

“Cinema is still the most amazing medium for any creative person to work in. A place for you to tell your story on the ‘mother of all screens’. It’s not surprising that it’s so important and continues to capture the public’s imagination”, said Sir John Hegarty.

For more information about the “Feed Our Future” cinema campaign, and to learn how to get involved in creating a world with Zero Hunger, please visit: www.wfp.org.

Source: SAWA

Related Articles:

SAWA | Feed Our Future | Global Cinema Ad

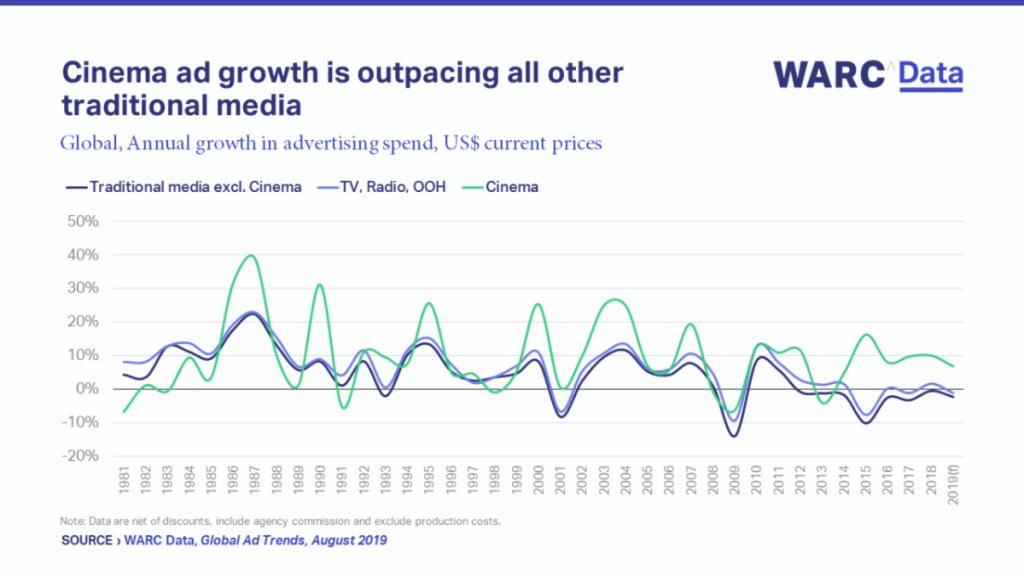

Cinema advertising growth is outpacing all other traditional media, as Netflix’s rise shows no notable impact

The global cinema advertising market is expected to be worth $4.6bn this year, representing a 6.8% rise from 2018. This is ahead of the all media growth forecast by WARC, the international marketing intelligence service, of 4.6% for 2019 (to $624.9bn), and places cinema as the second-fastest growing ad medium this year, behind internet as a whole.

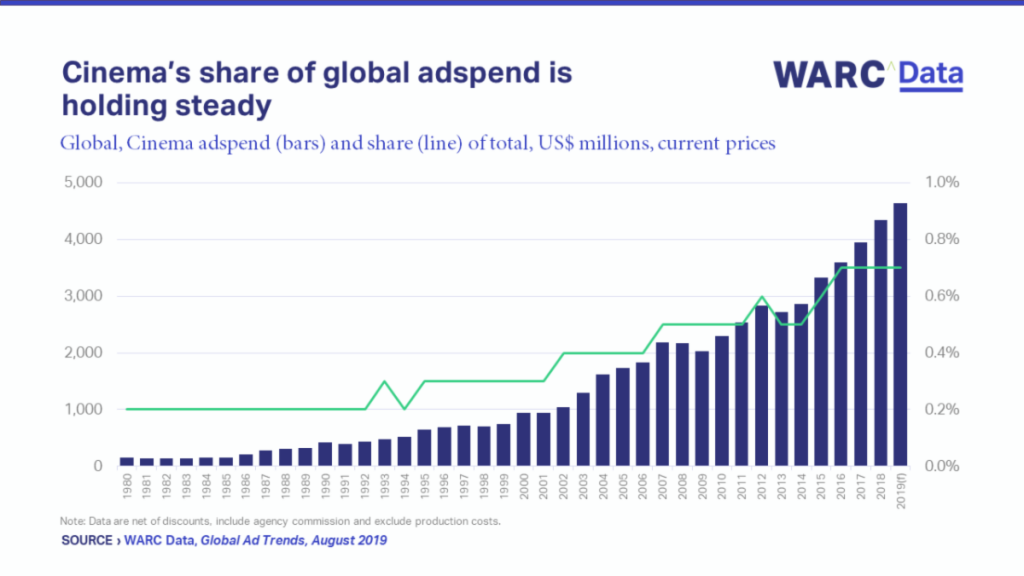

Cinema’s share of global adspend is holding steady

While small, cinema’s 0.7% share of global adspend is expected to hold steady in 2019, making it the only medium other than internet not to lose share. Figures from WARC’s Adspend Database show that cinema’s share of global adspend has dipped only twice since 1980 (1994 and 2013) and growth in cinema ad investment has generally tracked ahead of other traditional media since 1981, and consistently so since 2014.

In Europe, advertisers spend 1.6 times more on cinema per admission than in the US. The UK leads the way, with spend per admission rising from £0.18 in 1980 to £1.43 last year, when 177m admissions were recorded – the highest on record. This despite 46% of UK consumers stating that Netflix is their first choice for watching movies, according to GlobalWebIndex.

China is driving global growth, US brands are under-investing

China is the largest cinema ad market globally, with RMB11.9bn (US$1.8bn) expected to be spent this year. This equates to a 47.3% share of global cinema adspend when measured in Purchasing Power Parity terms. Further, China has accounted for three quarters (74.9%) of global growth in cinema adspend since 2015, on average, and is expected to contribute 87.4% towards global cinema growth this year. IHS figures suggest that the number of cinema screens in China increased by 9,303 in 2018 alone, or 26 per day on average.

In the US, the world’s second-largest cinema market with a projected value of $735m this year, the medium draws less than half a percent (0.4%) of media budgets on average. Seven product categories allocate more than this, most notably food, for which cinema accounts for 1.5% of all media spend. Non-profit (1.0%), telecoms & utilities (0.7%), alcoholic drinks (0.7%), automotive (0.6%), transport & tourism (0.6%) and financial services (0.5%) also record investment levels above the US average.

DCM recommends that brands invest a minimum of 2.7% of budgets in cinema, with some sectors like travel & tourism seeing optimal levels of campaign ROI when allocating as much as 11%.

Attentive audiences ensure cinema ads get noticed in a brand-safe environment, while young audiences have a positive affinity with the medium

Captive audiences viewing high-quality ads in an emotional atmosphere is a draw for advertisers. Research by Ebiquity has found that Cinema outperforms all other media at triggering an emotional response, guaranteeing a safe environment, and getting ads noticed. However, the medium scores lowest in increasing campaign ROI, maximizing campaign reach, and generating short-term sales.

Cinema attracts a younger, more affluent audience who tend to be lighter TV viewers. According to IPA TouchPoints 6, cinema delivers a more positive emotional experience than any other AV channel (84% of time spent at the cinema is associated with positive emotions for 16+ adults, versus 60-65% for live TV, longform VOD and short online video). Kantar Millward Brown has also found that among ‘Gen Z’ (16-19 year-olds), cinema is the most popular traditional advertising medium with 59% feeling ‘positive about it’ (compared to 34% for print, 38% for TV and 50% for outdoor).

Consumers now spend more on streaming movies than visiting the cinema, but Netflix has yet to hit the box office

Data from the Motion Picture Association of America (MPAA) show that the amount consumers spend on digital home entertainment, including on online subscriptions such as Netflix, surpassed the amount spent at the cinema globally for the first-time last year ($42.6bn versus $41.1bn). This landmark had already been reached in the US during 2015.

Over the course of an average year, a Netflix subscription will cost a consumer US$113.16. This compares to the $45.55 a North American will spend at the cinema each year on average, with the equivalent figures for the UK and the EU at $25.13 and $11.04 respectively.

In the US, a moviegoer visited the cinema five times on average in 2018, which roughly equates to 263m consumers going every two months. But with almost three-quarters (74%) of Americans now using an online subscription – and 84% using a pay TV channel – to watch a movie at least 2-3 times each month, viewership in the living room may have reached parity with the silver screen.

James McDonald, Managing Editor, WARC Data, and author of the research, says: “The experiential nature of cinema places it in a different bracket to SVOD services, which instead occupy a similar space to traditional TV. This, coupled with the exclusivity of box office hits – particularly franchises – should ensure any downward pressure from SVOD services is minimal in the short term.

“Cinema offers advertisers access to younger, more affluent audiences who have an affinity with the medium. This enables ads to be screened in a brand safe environment where they will be noticed, often in a location that is close to a retail outlet and, by extension, a point of purchase.”

Global media analysis – Cinema

Other key media intelligence new on WARC Data

Global Ad Trends, a monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments, is part of WARC Data, a dedicated online service featuring current advertising benchmarks, forecasts, data points and trends in media investment and usage.

Download a sample report of WARC’s latest Global Ad Trends report on Cinema.

Source: WARC

From the lift of a 35-year ban on cinemas in Saudi Arabia, which has paved the way for cinema exhibitors to unveil six cinema locations (single screens and multiplexes) in Riyadh and Jeddah – with more on the way across the Kingdom, to a paradigm shift across the rest of the region where exhibitors are investing in opening new locations, renovating existing locations, offering innovative ways to watch a movie – luxury cinema seating and F&B options to suit a variety of moods, the overall ambience of cinema has redefined movie going experiences in the Middle East.

Superhero and action movies are no doubt the most popular with audiences of this region. Nevertheless, irrespective of the movie genre, cinemas continue to have a consistent line-up of blockbusters throughout the year – delivering impressive admission figures.

Whether launching a new brand or product, marketing a special event or new residential complex, promoting a special offer or advertising a brand awareness campaign, cinema is the ultimate platform for memorable storytelling, helps advertisers target specific audiences, builds deeper audience engagement and delivers valuable incremental reach when added to a brand’s media mix.

Check out Motivate Val Morgan’s Cinema Update for 2018, and make cinema an integral part of your media plan in 2019!

Spotlight on Motivate Val Morgan

Cinema – A Force to Reckon With (Section 1)

Cinema – A Force to Reckon With (Section 2)

Cinema – A Force to Reckon With (Section 3)

Contact a member of our sales team for cinema advertising opportunities in 2019